Retail Customers' Mall-Behaviour

Almost a century ago, Melvin Copeland classified goods into convenience goods, shopping goods and speciality goods (HBR, 1923), based on brand map in consumers’ mind and her clarity

of brand preference.

a. Convenience goods are

those where the consumer has a clear brand map in her mind and is neutral among

the brands. She chooses the brand readily available.

b. Shopping goods are

those where the consumer forms the map by comparing various brands and then

decides the brand to buy.

c. Speciality goods

are those where the consumer has a clear brand map and specific brand

preferences ahead of purchase.

Almost forty years later, Bucklin extended the thinking to

classify retail outlets similarly to explain consumers’ buying habits for

different goods in different outlets (JoM,

Oct-1962, p.53 ).

i. Convenience Stores: Those stores for which the

consumer possesses a preference map that indicates a preference to buy from the

most accessible store.

ii. Shopping

Stores: Those

stores for which the consumer has not developed a complete preference map relative,

requiring him to undertake a search to construct such a map before purchase.

iii. Specialty Stores: Those stores for which the

consumer possesses a preference map that indicates a clear preference to buy

from a particular outlet even though it may not be the most accessible.

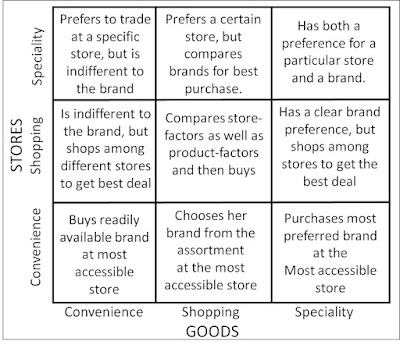

It thus gives us nine possibilities as explained in the

matrix below (Source: Bucklin, 1962, pp. 53-54).

It is not possible to imagine

consumers’ buying behaviour in terms of brand-store combination beyond these

nine cells. What is of interest is how the behaviours are migrating from one

cell to another over time. For example, when I was in school (1960s/1970s), a ballpoint

pen was a cherished item. We would go to a stationery store to buy a specific brand

of ballpoint pen, and then regularly buy the refills. It was almost a Speciality Good and Speciality Store combination. In the present context, it has moved

completely South West to Convenience Good

and Convenient Store cell. In Henry

Assael’s framework of buying characteristics, the consumer has gravitated from Complex Buying Behaviour to Routine Buying Behaviour.

Retail and Marketing have since then come a long way, with

the interest of scholars now resting on multi-channel strategy and special

attention on modern format retailing (MFR), hypermarkets, and malls. With these developments, it is

interesting to observe changes in buying behaviour, especially in the Malls. Why do buyers throng Malls? What does a Mall offer functionally, in addition to the shopping experience? And,

what becomes of buying behaviour for a product category, say grocery, when in a

mall?

Historically, consumers have been purchasing periodically

from the neighbourhood kirana stores

or a super market. Since long, the neighbourhood kirana stores offered monthly credit to their middle-income

customers to gain their store loyalty. Certain small super markets located in

residential localities too offered credit to regular customers, sometimes combined

with door delivery. Thus, though in a

large way, these stores were convenience stores for routine purchases, they

became speciality stores for monthly rations.

Typically, a visit to kirana

stores or neighbourhood supermarket was characterised by a list of items based

on which purchases were made; deviations from the list were minimal. However,

this trend has changed with the advent of malls;

while the list still functioned as the purchase-guide, the percentage of

unplanned purchases has increased dramatically between 25% and 35%. Such

quasi-impulse purchases are mainly influenced by the store ambience, display of

materials, attraction of offers and in-shop promotions.

Another important and noticeable change is the gravitation

of certain categories from convenience good to shopping good, as not the

consumer is able to spend adequate time to compare across the brands in terms

of offers/deals, contents and packaging. Earlier, such categories witnessed the

customer mostly asking for or picking up the top-of-the-mind brand (not necessarily

implying brand loyalty).

The malls having

become an outing by itself has made household shopping a leisurely experience,

giving the customer adequate time to shop around than to purchase in a rush and

move on. The average time a customer spends in a super market in a mall is

about 35% more than the time spent in a standalone super market. A few known

reasons for this behaviour are

1.

Customer having more time to shop around

2.

Larger number of product categories available

3.

More in-shop promotions

4.

The expanse ambience working on the psyche to

buy more

It is worthwhile to note that though the expanse ambiance

opens up the customer’s heart to spend more, a typical Indian customer still

looks for value for money and hence the supermarkets in the malls do not charge premium but offer

sumptuous discounts on various brands to keep the attraction on. Loss leader pricing is a usual tactic

adopted by the supermarkets to invite greater footfall. This is usually offered

on items that are normally purchased in smaller units, those which last for a

month or two in a household. This is possible because these supermarkets are

able to negotiate better deal with their vendors, which they pass on to their

customers to remain attractive. Except for cereals, pulses, fruits, vegetables,

meat and fish, most of the other items are sold in packed and branded form.

Hence, the large margins are gained from these products that are vended in

loose, but are consumed in larger quantity in the households.

A caveat is necessary: organised retailing in India is still

below 7% of the total. Supermarkets within malls

account for less than 2% and this is likely to grow slowly. A typical customer

of these Super Markets is a graduate or above, around 30 years old, married

with a monthly family earning of around Rs.50000. This significantly accounts

for the demographic dividend that India brags about. This segment is here to

stay and grow while these customers will migrate to habituated mall-visitors. Their requirements

include shopping experience, ambiance, choice, value for money, and expert

advice on certain items.

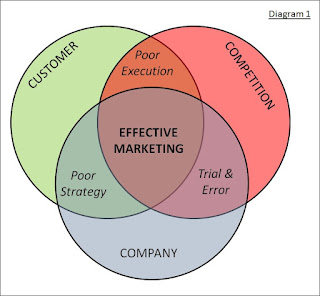

Companies marketing FMCG products may well recognise

that in about ten years from now 17% of retailing will be from self-service

super markets and by then consumer awareness of products, choices and search

will be of very high order. The transaction cost in these channels will become

the lowest and hence it is worthwhile to invest in promoting sales through this

channel more and more. Convenience stores will continue to exist but will lose

significance in twenty years.

Comments

Post a Comment